How Much Is Property Tax In Dublin Ohio . The local income tax rate is 2.0% and applies to gross wages, salaries, compensation, and net profits of businesses and rentals. Our ohio property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden. The statistics from this question. Please note that we can only. Property taxes are based on the tax rate where the property is located and the taxable value (based on 35% of market value) of the. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Property taxes are based on the tax rate where the property is located and the taxable value (based on 35% of market value) of the property as. The city of dublin provides 100% credit up to 2.0% for taxes.

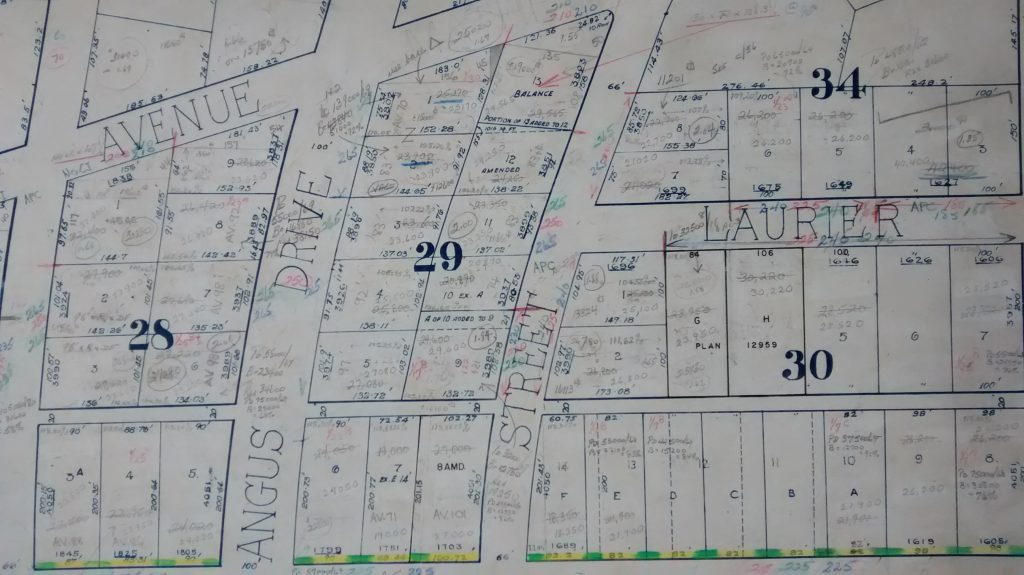

from www.vancouverarchives.ca

To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Please note that we can only. Property taxes are based on the tax rate where the property is located and the taxable value (based on 35% of market value) of the property as. The local income tax rate is 2.0% and applies to gross wages, salaries, compensation, and net profits of businesses and rentals. Our ohio property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden. The city of dublin provides 100% credit up to 2.0% for taxes. The statistics from this question. Property taxes are based on the tax rate where the property is located and the taxable value (based on 35% of market value) of the.

Property tax assessment maps now available AuthentiCity

How Much Is Property Tax In Dublin Ohio Please note that we can only. Please note that we can only. Our ohio property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden. The city of dublin provides 100% credit up to 2.0% for taxes. The local income tax rate is 2.0% and applies to gross wages, salaries, compensation, and net profits of businesses and rentals. Property taxes are based on the tax rate where the property is located and the taxable value (based on 35% of market value) of the. Property taxes are based on the tax rate where the property is located and the taxable value (based on 35% of market value) of the property as. The statistics from this question. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address.

From www.captivatinghouses.com

1907 Historic House In Dublin — Captivating Houses How Much Is Property Tax In Dublin Ohio Property taxes are based on the tax rate where the property is located and the taxable value (based on 35% of market value) of the. The city of dublin provides 100% credit up to 2.0% for taxes. The statistics from this question. To calculate the exact amount of property tax you will owe requires your property's assessed value and the. How Much Is Property Tax In Dublin Ohio.

From summitmoving.com

Summit County Property Tax [2024] 💰 Guide to Summit County Ohio How Much Is Property Tax In Dublin Ohio Property taxes are based on the tax rate where the property is located and the taxable value (based on 35% of market value) of the property as. Our ohio property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden. Property taxes are based on the tax rate where the property. How Much Is Property Tax In Dublin Ohio.

From www.cleveland.com

Find out where your city or township ranks for property tax rates in How Much Is Property Tax In Dublin Ohio The statistics from this question. Our ohio property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden. Please note that we can only. Property taxes are based on the tax rate where the property is located and the taxable value (based on 35% of market value) of the. The local. How Much Is Property Tax In Dublin Ohio.

From www.financestrategists.com

Find the Best Tax Preparation Services in Dublin, OH How Much Is Property Tax In Dublin Ohio The statistics from this question. Property taxes are based on the tax rate where the property is located and the taxable value (based on 35% of market value) of the property as. Our ohio property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden. The city of dublin provides 100%. How Much Is Property Tax In Dublin Ohio.

From www.zillow.com

6674 Traquair Pl, Dublin, OH 43016 Zillow How Much Is Property Tax In Dublin Ohio Property taxes are based on the tax rate where the property is located and the taxable value (based on 35% of market value) of the property as. Property taxes are based on the tax rate where the property is located and the taxable value (based on 35% of market value) of the. The local income tax rate is 2.0% and. How Much Is Property Tax In Dublin Ohio.

From housejullla.blogspot.com

House For Rent Dublin Ohio housejullla How Much Is Property Tax In Dublin Ohio Property taxes are based on the tax rate where the property is located and the taxable value (based on 35% of market value) of the property as. Property taxes are based on the tax rate where the property is located and the taxable value (based on 35% of market value) of the. Please note that we can only. To calculate. How Much Is Property Tax In Dublin Ohio.

From www.realtor.com

Muirfield Village, Dublin, OH Real Estate & Homes for Sale How Much Is Property Tax In Dublin Ohio Property taxes are based on the tax rate where the property is located and the taxable value (based on 35% of market value) of the. Please note that we can only. The statistics from this question. Property taxes are based on the tax rate where the property is located and the taxable value (based on 35% of market value) of. How Much Is Property Tax In Dublin Ohio.

From fill.io

Fill Free fillable forms City of Dublin, Ohio How Much Is Property Tax In Dublin Ohio Please note that we can only. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Our ohio property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden. The local income tax rate is. How Much Is Property Tax In Dublin Ohio.

From www.frg.ie

Local Property Tax Survey for Dublin FRG.ie How Much Is Property Tax In Dublin Ohio The city of dublin provides 100% credit up to 2.0% for taxes. Property taxes are based on the tax rate where the property is located and the taxable value (based on 35% of market value) of the property as. Our ohio property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. How Much Is Property Tax In Dublin Ohio.

From www.cleveland.com

Northeast Ohio property tax rates, typical and highest tax bills in How Much Is Property Tax In Dublin Ohio Our ohio property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden. The local income tax rate is 2.0% and applies to gross wages, salaries, compensation, and net profits of businesses and rentals. Property taxes are based on the tax rate where the property is located and the taxable value. How Much Is Property Tax In Dublin Ohio.

From www.newsncr.com

These States Have the Highest Property Tax Rates How Much Is Property Tax In Dublin Ohio Please note that we can only. The statistics from this question. The local income tax rate is 2.0% and applies to gross wages, salaries, compensation, and net profits of businesses and rentals. Our ohio property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden. Property taxes are based on the. How Much Is Property Tax In Dublin Ohio.

From jamimakorella.pages.dev

Ohio Sales Tax Rates 2024 2024 Ilise Dorothee How Much Is Property Tax In Dublin Ohio Please note that we can only. The statistics from this question. The city of dublin provides 100% credit up to 2.0% for taxes. The local income tax rate is 2.0% and applies to gross wages, salaries, compensation, and net profits of businesses and rentals. Property taxes are based on the tax rate where the property is located and the taxable. How Much Is Property Tax In Dublin Ohio.

From prorfety.blogspot.com

Commercial Property For Sale Dublin Ohio PRORFETY How Much Is Property Tax In Dublin Ohio To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Please note that we can only. The local income tax rate is 2.0% and applies to gross wages, salaries, compensation, and net profits of businesses and rentals. Property taxes are based on the tax. How Much Is Property Tax In Dublin Ohio.

From jessqtamarra.pages.dev

Oh State Tax Rate 2024 Herta Madelena How Much Is Property Tax In Dublin Ohio The local income tax rate is 2.0% and applies to gross wages, salaries, compensation, and net profits of businesses and rentals. The city of dublin provides 100% credit up to 2.0% for taxes. The statistics from this question. Please note that we can only. To calculate the exact amount of property tax you will owe requires your property's assessed value. How Much Is Property Tax In Dublin Ohio.

From dublinohiousa.gov

Taxation City of Dublin, Ohio, USA How Much Is Property Tax In Dublin Ohio Our ohio property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Property taxes are based on the tax rate where the property is. How Much Is Property Tax In Dublin Ohio.

From www.realtor.com

Dublin, OH Mobile & Manufactured Homes for Sale How Much Is Property Tax In Dublin Ohio Please note that we can only. Property taxes are based on the tax rate where the property is located and the taxable value (based on 35% of market value) of the property as. Our ohio property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden. The city of dublin provides. How Much Is Property Tax In Dublin Ohio.

From www.ohiomfg.com

Comparison Property Taxes by County, State The Ohio Manufacturers How Much Is Property Tax In Dublin Ohio The city of dublin provides 100% credit up to 2.0% for taxes. Property taxes are based on the tax rate where the property is located and the taxable value (based on 35% of market value) of the. The statistics from this question. Please note that we can only. To calculate the exact amount of property tax you will owe requires. How Much Is Property Tax In Dublin Ohio.

From www.cleveland.com

Compare new property tax rates in Greater Cleveland, Akron; part of How Much Is Property Tax In Dublin Ohio Property taxes are based on the tax rate where the property is located and the taxable value (based on 35% of market value) of the property as. Property taxes are based on the tax rate where the property is located and the taxable value (based on 35% of market value) of the. Our ohio property tax calculator can estimate your. How Much Is Property Tax In Dublin Ohio.